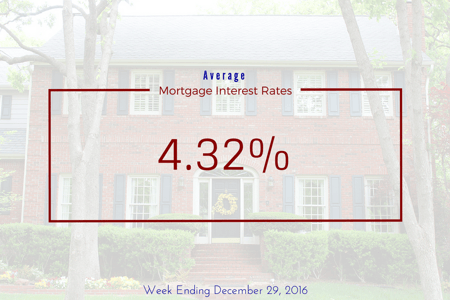

U.S. average mortgage interest rates increased for the ninth consecutive week, according to Freddie Mac's Primary Mortgage Market Survey.

For the week ending December 29, 2016, the 30-year, fixed rate mortgage loan averaged 4.32 percent, with an average 0.5 point, an increase from 4.30 percent the previous week. A year ago the same week the 30-year note average 4.01 percent.

For the week ending December 29, 2016, the 30-year, fixed rate mortgage loan averaged 4.32 percent, with an average 0.5 point, an increase from 4.30 percent the previous week. A year ago the same week the 30-year note average 4.01 percent.

"On a short week following the Christmas holiday, the 10-year Treasury yield was relatively unchanged," Sean Becketti, Freddie Mac's chief economist, said. "The 30-year mortgage rate rose 2 basis points to 4.32 percent, closing the year with nine consecutive weeks of increases. As mortgage rates continue to increase, home sales and affordability will continue to be a concern for housing in 2017."

Despite interest rates closing the year higher, the annual average (3.65 percent) for 2016 was the lowest ever recorded dating back to 1971 when Freddie Mac started the Primary Mortgage Market Survey.

The 15-year, fixed rate mortgage increased 3 basis points to 3.55 percent, with an average 0.5 point. A year ago the 15-year loan averaged 3.24 percent.

The five-year, adjustable-rate mortgage declined 2 basis points 3.30 percent, with an average 0.5 point.