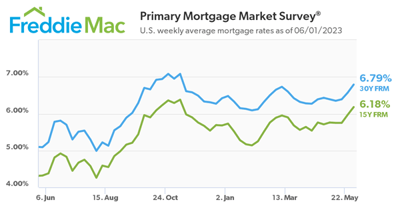

The average rate in the United States for the 30-year, fixed-rate mortgage rose nearly a half point for the week ending June 1, 2023, according to Freddie Mac's weekly Primary Mortgage Market Survey (PMMS).

The 30-year, fixed-rate mortgage loan spiked to 6.79 percent, up from the prior week's 6.57 percent. Last year at this time, the 30-year note averaged 5.09 percent.

The 30-year, fixed-rate mortgage loan spiked to 6.79 percent, up from the prior week's 6.57 percent. Last year at this time, the 30-year note averaged 5.09 percent.

The average rate for the 15-year, fixed-rate mortgage, a popular choice to refinance, reached 6.18 percent, up from 5.97 percent the week before and 4.32 percent the previous year.

Homebuyer demand has remained strong throughout Greater Boston in 2023 – multiple-offer situations are still the norm – but mortgage interest rates are reaching levels not seen since last fall when the 30-year loan surpassed 7 percent. Higher interest rates will make an already expensive housing market less affordable.

"Mortgage rates jumped this week, as a buoyant economy has prompted the market to price in the likelihood of another Federal Reserve rate hike," Freddie Mac's chief economist, Sam Khater, said. "Although there has been a steady flow of purchase demand around rates in the low to mid six percent range, that demand is likely to weaken as rates approach seven percent."

Related: Talk to a Home Loan Expert

The Mortgage Banker's Association (MBA) reported on May 31, 2023, that its Weekly Mortgage Applications Survey for the week ending May 26, 2023, showed homebuyer demand for mortgages has cooled.

The seasonally adjusted "Purchase Index" decreased by 3 percent from the previous week. The unadjusted Purchase Index decreased by 4 percent compared with the prior week and was 31 percent lower than the same week in 2022.

"Inflation is still running too high, and recent economic data is beginning to convince investors that the Federal Reserve will not be cutting rates anytime soon," said Mike Fratantoni, MBA's SVP and Chief Economist. "Mortgage rates for conforming, balance 30-year loans were being quoted above 7 percent by some lenders last week, and the weekly average at 6.9 percent reached the highest level since last November."

Mortgage applications declined for the third consecutive week.

"Application volumes for both purchase and refinance loans decreased last week due to these higher rates," Fratantoni said. "While refinance demand is almost entirely driven by the level of rates, purchase volume continues to be constrained by the lack of homes on the market."

Freddie Mac's PMMS is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit.

The MBA's Weekly Mortgage Applications Survey covers more than 75 percent of all U.S. retail residential mortgage applications and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks, and thrifts.