After declines earlier in the week, a stronger-than-expected jobs report sent U.S. mortgage interest rates soaring on Friday, February 2, 2024, according to the Mortgage News Daily (MND) Rate Index.

Nonfarm payrolls expanded by 353,000 in January, far surpassing 185,000 jobs anticipated by economists polled by Dow Jones, CNBC reported. Wage growth data pointed to continued inflationary pressures. Payrolls were also revised significantly up for December to 333,000 from 216,000.

Nonfarm payrolls expanded by 353,000 in January, far surpassing 185,000 jobs anticipated by economists polled by Dow Jones, CNBC reported. Wage growth data pointed to continued inflationary pressures. Payrolls were also revised significantly up for December to 333,000 from 216,000.

The robust jobs report adds to the likelihood that the Federal Reserve will not cut interest rates as soon as Wall Street had hoped.

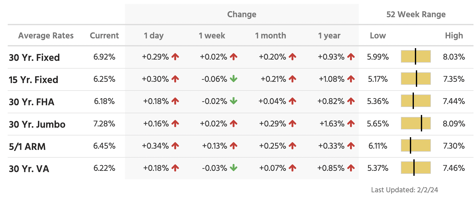

The MND Rate Index (see image) jumped 29 basis points from Thursday to 6.92 percent, the biggest one-day jump since October 2022. Mortgage interest rates had declined a quarter point over the three days before Friday.

Prospective home buyers should note that better interest rates may be available locally. It's essential to take the time to discuss your specific details with a local loan officer from a reputable mortgage company or bank. Not doing so is a common home-buying mistake.

Mortgage Demand Cools

According to the Mortgage Bankers Association (MBA), after rising for several weeks due to declining interest rates, mortgage applications to purchase a home for the week ending January 26, 2024, fell 11 percent compared to the previous week. Purchase applications were 20 percent lower than at the same time last year.

"Low existing housing supply is limiting options for prospective buyers and is keeping home-price growth elevated, resulting in a one-two punch that continues to constrain home purchase activity," Joel Kan, MBA's vice president and deputy chief economist, said.

The average loan size for purchase applications has risen for several weeks, reaching $444,100 last week, the largest loan amount since May 2022.

Over the past few months, lower mortgage rates have brought more home buyers into the market, increasing competition and putting upward pressure on home prices.

In Greater Boston, the median price of a single-family home reached $800,000 in December – a record high for the month – an 8 percent increase from $740,000 in December 2022.

According to the Greater Boston Association of Realtors (GBAR), condominium prices jumped 14 percent in December to $697,000 compared to $611,500 in December 2022. GBAR's area includes Boston and 63 other surrounding cities and towns.

Despite increases in home prices, price growth moderated statewide in 2023.